Some Chief Appraisers are nervous that they might get fired if they switch their appraisal management platform.

No Chief Appraiser has ever been fired because they chose YouConnect.

My promise?

“I will personally give you half your annual salary if you get fired due to YouConnect not performing.”

Why am I so confident?

- We added 3 bank clients from the legacy platform, 1 per week for the past 3 weeks.

- Our clients include Fifth Third, Deutsche Bank and BNY.

- Our NPS score is excellent.

- We authentically care about the valuation industry, creating podcasts (Indispensable Appraisers), blogs (this one) and FIVA (Financial Institution Valuation Advisors).

- We offer bank-wide integration solutions (including LOS to YouConnect) with

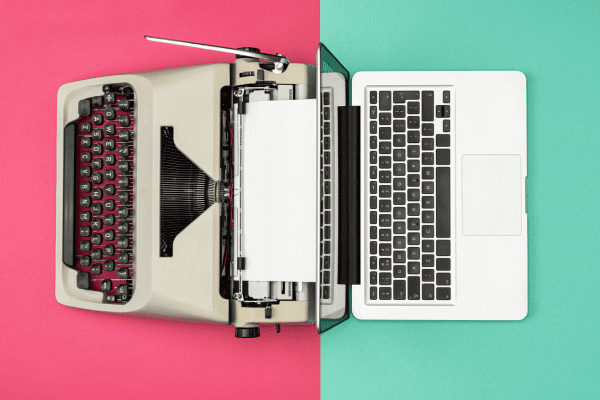

Legacy platforms are familiar, reliable (most of the time) and deeply integrated into your bank’s operations.

However, these systems are often cumbersome, inflexible and ill-equipped to handle custom changes.

The fear of disrupting established workflows and the perceived risks of transitioning to a new system can make staying put seem like the safer choice.

But consider this: staying with a legacy system is not without risks. Outdated platforms can lead to inefficiencies, most of which is increased frustration by the lack of custom changes you need to meet your specific department workflow.

The Case for YouConnect

- Customization and Support: YouConnect’s biggest strength lies in its customization capabilities. Every bank has unique needs and YouConnect can be tailored to fit those specific requirements. Moreover, the excellent client success support ensures that any issues are promptly addressed and your team is well-equipped to leverage the platform’s full potential.

- Transparency and Collaboration: The platform fosters better communication and transparency between lending and credit teams. With YouConnect, everyone has access to the same real-time information, which enhances collaboration and decision-making.

- Vendor Management: Managing vendors can be a complex and time-consuming task. YouConnect simplifies this with comprehensive vendor management features, like appraiser-assignment location specific maps, ensuring that you work with the best vendors efficiently and effectively.

- Regulatory Compliance: In today’s regulatory environment, compliance is non-negotiable. YouConnect’s centralized data access that’s property centric makes it easier to gather the necessary documentation for audits, demonstrating compliance and reducing the risk of penalties.

- Ease of Integration: Our Glances solution provides bank-wide integrations with your Core systems, LOS and other critical platforms without requiring bank IT resources. This seamless integration means you can transition smoothly, without the typical time-consuming, expensive and heavy IT work.

Overcoming the Fear of Change

The move to an appraisal management system that’s very customizable with responsive support is not just a technological upgrade – it’s a strategic decision that positions your department for future success.

Good strategic decisions far outweighs the fear of leaving the comfort of the known for the promise of the new.

YouConnect provides a better experience for your lenders, vendors and staff.

The appraisal management software your department wants. The partnership you deserve.