Appraisers undervalue their worth.

The bank C-Suite is largely unaware of the market knowledge depth of their own appraisal department.

Their approved appraiser vendors are top-notch.

Both are integral to the stability of the real estate industry.

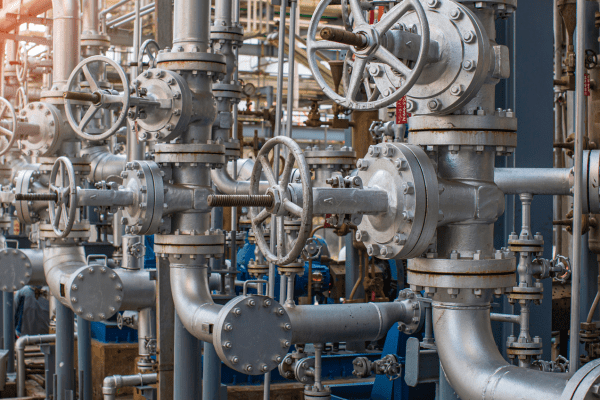

Like oil pipelines that fuel our industries, appraisers channel the valuable information banks need to make informed financial decisions.

Appraisers: The Stewards of Market Data

Real estate appraisers serve as the stewards of market data. Their role goes beyond collection and analysis; they ensure the integrity and reliability of the information they handle.

Imagine a world without these diligent professionals: just as pipelines ensure that oil reaches its destination without leaks or contamination, appraisers ensure that data remains accurate and actionable.

Without their expertise, banks would lack the solid foundation required for strategic decision-making.

We need to do a better job of getting this message out.

Market Data: The New Oil

Market data includes property values, market trends and economic indicators. Like oil, this data needs to be extracted, refined and transported efficiently.

Banks rely on this data to guide their strategies, assess risks and uncover opportunities.

Without a steady flow of accurate data, the entire system falters.

Glances: Connecting the Dots

Enter Glances—an advanced integration software that acts as the connective tissue of the banking ecosystem. Glances integrates Core banking systems, Loan Origination Systems (LOS), appraisal management platforms and legacy systems into a unified view.

This integration is akin to a sophisticated network of pipelines, designed to optimize the flow of data, reduce friction and ensure every bit of information is utilized effectively.

Glances transforms data into a seamless stream of actionable insights.

Data: The Catalyst for Innovation

With the integration capabilities of Glances, banks can harness their data’s full potential, transforming it into strategic advantages.

This new level of integration allows for greater agility, foresight and a more customer-centric approach.

The Unified View: A New Paradigm

A unified view of data represents a paradigm shift. It enables banks to move beyond silos and see the big picture.

This comprehensive perspective fosters real-time decision-making, enhances transparency and promotes collaboration across departments.

Glances bridges the gaps between disparate systems and creating a cohesive data ecosystem.

It’s not just about connecting systems; it’s about transforming how we see and use data.

Looking Ahead: The Future of Appraisal and Banking

The future of real estate appraisal and banking is bright only if we drive the narrative.

As appraisers continue to act as the vital conduits for market data, tools like Glances will amplify their impact.

By ensuring the smooth flow of data and creating a unified view, banks can drive growth, innovation and success.

The synergy between skilled appraisers and simplified integration tools like Glances will propel the industry forward.

Turn challenges into opportunities and reshape the commercial real estate landscape.

The real strength lies not just in the data itself, but in how we harness, integrate and apply it.

Appraisers are at the forefront of this transformation, pipelines of progress.

Can we continue to be that valuable conduit of market insight?

Let’s collectively articulate our value.

No one else will.